Why Is My Continuing Disability Review Taking So Long

Past Barbara Knoblach, PhD, CFP®

With every changing flavour or life stage, we tend to reverberate and wait towards the hereafter. We hold memories close and feel excited most what is to come up.

Such reflection is an opportunity to pause and remember why y'all work hard and to recommit to your life goals – including the important retirement goals. Who doesn't dream of the 24-hour interval when all iv seasons are theirs to shape and relish?

Retirement looks very unlike to everyone, and one of the most important things to consider when planning yours is the optimal time to apply for Canada Alimony Plan (CPP) benefits. Also as some of our latest recommendations:

- Strategies for How to Budget for the New Normal

- The Financial Realities of Retirement during the COVID-19 Pandemic

- Is Financial Freedom However Possible?

All information technology takes is a bit of calculated foresight to make the decision that volition all-time adjust your circumstances.

Here's a expect at some nuts:

Canada Alimony Plan benefits tin be drawn as early as age lx (reduced 0.6% for each month before 65) or as late as age 70 (increased 0.7% for each month after 65).

The boilerplate life expectancy for Canadians is age 80 for men and 84 for women. Statistics Canada predicts a continued ascent in life expectancy of roughly ii years over the next 15 years.

Things to consider:

Life expectancy

Contemplating your mortality may feel uncomfortable, but it should non be ignored. Your health and whether longevity is a family trait, are things to consider when making your decision regarding CPP.

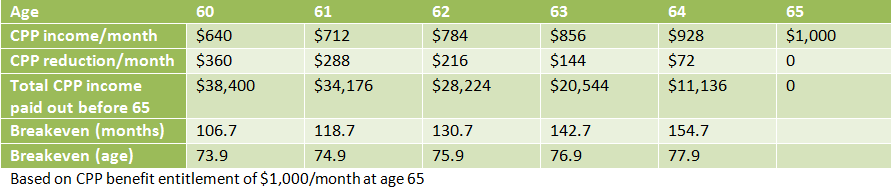

If you take your CPP starting at historic period sixty, your breakeven indicate with someone who waits until age 65 is when y'all both turn 74. Dislocated? Allow me put it another way – I will use an example to illustrate my point.

If Mary takes her CPP at 60 and Brenda takes hers at 65, Mary's monthly CPP payment will be 36% lower than Brenda's, but she will collect five years longer. They will be 74 when Brenda pulls ahead of Mary for overall amount collected.

CPP Breakeven Point Chart

Working and collecting CPP

Working and collecting CPP

If you believe good genes are on your side and there is a strong adventure you'll exist collecting CPP into your 80s, information technology may be beneficial to look until age 70, but but if you tin beget to do and then. How much cash flow y'all accept from other sources is as of import a consideration equally your health. If you are living on a restricted income, it may exist improve to accept CPP sooner and enjoy an improved quality of life while you are best able to appreciate it.

Fifty-fifty if you don't retire at historic period lx, you lot are eligible to collect CPP. Simply you and your employer volition all the same be required to make CPP contributions until age 65. If you are still working between ages 65 and 70, y'all are no longer required to contribute if yous are collecting CPP, though y'all may choose to, thereby increasing your CPP benefits.

CPP benefit entitlements

It's also important to understand how much CPP benefit yous are entitled to before you decide the optimum time to collect.

Equally of 2020 the maximum benefit is $1,175.83 per calendar month, but you might not qualify for the maximum. Information technology all depends on how much you contributed over the class of your working life. Co-ordinate to the Authorities of Canada website, the average corporeality new beneficiaries received at age 65 was $672.87 in 2019. If you would like to know how much y'all can look to receive, you can request a Statement of Contributions through your Service Canada account.

CPP is part of a bigger program

Ultimately the decision on when to use for CPP should be part of a broader retirement programme. It'due south important to develop as clear a snapshot of your retirement income and expenses as possible. Practise you plan to travel or are y'all likely to be more of a homebody? Volition you lot be joining a golf club, or buying season tickets for your city's sports team or theatre visitor? Do y'all foresee downsizing your home? If not, will you lot be mortgage free? What about vehicles? Will you and your partner downsize to one vehicle? Are there health concerns that may need all-around? Will you desire assistance, such as cleaning services and backyard care, to help maintain your home? The questions you lot need to consider are as varied and numerous equally are retirement lifestyles.

Once you lot have a clearer picture of your possible expenses, you can stack those against your projected income sources. Aside from investment portfolio (RSPs, pensions, non-registered investments, stocks, and TFSAs), OAS, and CPP, perhaps you intend to work role-time equally a consultant in your by profession, or footstep out into something completely new.

It'southward essential to determine if at that place is a gap between the money you will need and the money you will have.

The sooner you discover that gap, the sooner you lot can start finding ways to shut it. If that sounds overwhelming, in that location is no need to do this on your own. A money motorcoach can aid y'all create a retirement plan that supports the future you desire. Contact one of our Coin Coaches and get started today.

This postal service offset appeared in 2016. It has been updated with current information and republished.

Annotation: The author is not able to address questions regarding an individual's specific financial situation. If you lot have a technical question regarding your CPP, please contact Service Canada. If you would like to discuss your retirement planning needs, nosotros encourage you to book a gratis, initial consultation with one of our Money Coaches.

Source: https://moneycoachescanada.ca/blog/take-cpp-age-60/

0 Response to "Why Is My Continuing Disability Review Taking So Long"

Postar um comentário